Publications

GST Guide

GST Guide to GSTR 2A GSTR 2B ITC reconciliation

GST Guide to GSTR 2A GSTR 2B ITC reconciliation

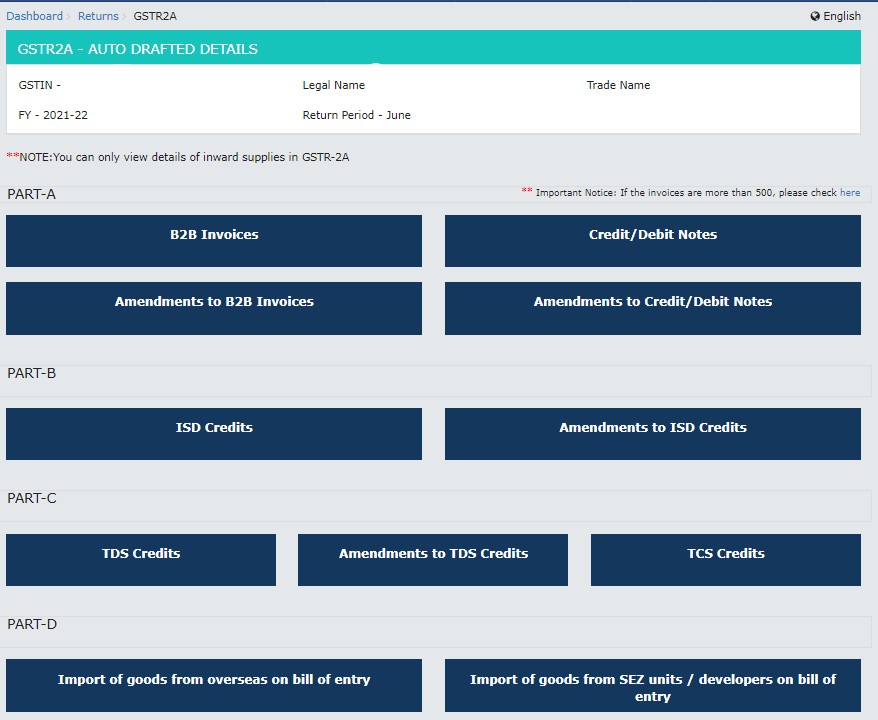

GSTR 2A is an automatically generated GST return which reflects the details of GST ITC (input tax credit) available month on month. GSTR 2A aggregates input credit in respect of purchases or services bought from suppliers. GSTR 2A also reflects the ITC arising on account of GST paid under reverse charge.

Other credits reflected include ISD credit (Input credit from Input Service Distributor) and TDS/TCS credits under GST. A GSTR 2A return will also include the reversal of ITC on account of sales returns via debit notes.

GSTR 2A is dynamic in nature. The month-wise ITC displayed may change basis the data updated in GSTR-1 or other monthly/quarterly returns filed by suppliers.

Click on the links to view the section

1) Purpose and importance of GSTR 2A

A registered GST taxpayer need not file the GSTR 2A with anyone. The GST registered user should use the GSTR 2A to reconcile the ITC or input tax credit available month wise. The GSTR 2A should be reconciled with the books of accounts.

It is important to reconcile GSTR 2A with books and with GSTR-2B as there are GST rules capping the input credit entitlement. Also, to ensure that ITC claims do not lapse. The last date to claim ITC for a financial year is 6 months from the end of the year. For example, the last date to claim ITC for FY 2020-21 is 30 September 2021.

A registered user can download GSTR 2A for any month to perform the reconciliation, however they cannot make any changes to the GSTR 2A.

It is also important to carry out the ITC reconciliation month wise and vendor wise to identify short claims or excess claims.

2) How to access your GSTR 2A and GSTR 2B?

In your GST user login, you can access and download GSTR 2A from the ‘Returns’ dashboard. You need to choose the period for which you require the GSTR 2A. You need to place a request for download in excel, the file will be available after 20 minutes.

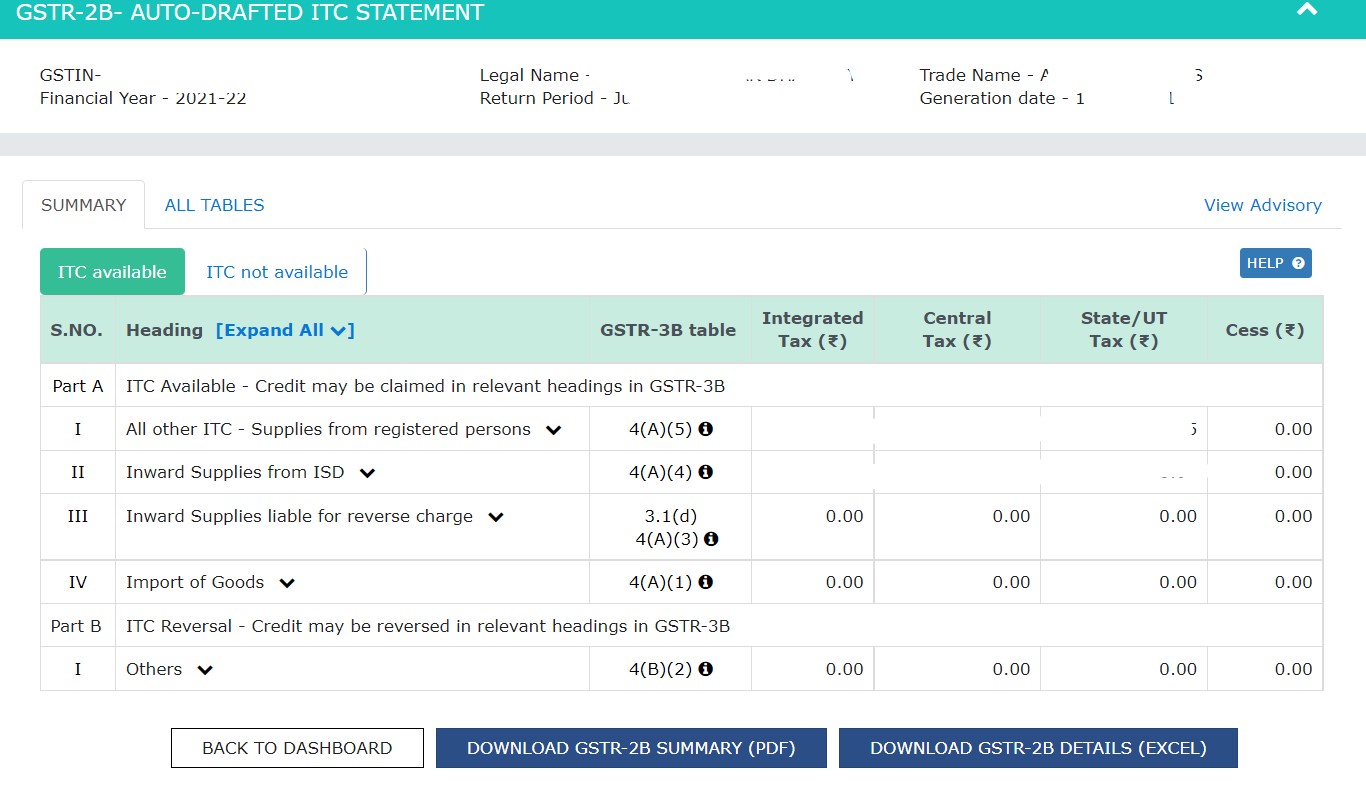

Similarly, in your GST login, you can access and download GSTR 2B from the ‘Returns’ dashboard by choosing the period. GSTR 2B is an auto drafted ITC statement.

Unlike GSTR 2A, the excel version of GSTR 2B is available for immediate download.

3) Reconciliation items in GSTR 2A with books of accounts

While reconciling the monthly GSTR 2A with the books of accounts, you may find mismatch with the purchase invoices as per your records. Some reasons for differences are:

-

- The supplier omits to upload the relevant sales invoice or makes an error in uploading the invoice

- The supplier files quarterly GSTR-1 and you file a monthly return

- Credit note issued but not recorded by supplier

- Mistakes in the data filed in the GSTR-1 such as GST number, transaction values, credit note etc.

- Invoice may be recorded in different months or different financial years

After reconciliation, you arrive at the eligible ITC as per your records. The next step is to reconcile the eligible ITC with GSTR-2B.

4) Reconciliation items in GSTR 2B with books of accounts

GSTR 2B is an auto drafted statement of eligible ITC for a month. The details in GSTR 2B are auto populated based on the returns filed by suppliers for a particular month. GSTR 2B aggregates the data from all the GSTR-1, GSTR-5 and GSTR-6. The purpose of GSTR 2B is to ease compliance of filing GSTR 3B by auto populating input tax credit.

A GSTR 2B contains data populated from 12th day of previous month up to 11th day of the current month. A GST registered user can generate the GSTR 2B as on 12th of the current month.

You must thoroughly check the GSTR 2B before claiming credit for ITC as it may contain invoices of previous month and any other month. For example:

| Invoice Date | GSTR-1 filed on | Reflecting in GSTR 2B | ITC eligible for |

|---|---|---|---|

| 10th August 2021 | 11th September 2021 | August 2021 (generated on 12th September 2021) | August 2021 month |

| 9th August 2021 | 11th October 2021 | September 2021 (generated on 12th October 2021) | September 2021. However, can be taken in August 2021 subject to 10% criteria |

| 25th February 2021 | 11th October 2021 | September 2021 (generated on 12th October 2021) | September 2021. However, verify if credit was taken in February 2021 |

GSTR 2B does not contain the reverse charge credit on import of services. The taxpayer should manually check and enter the same while filing GSTR 3B. The other ITC figures are auto populated from GSTR 2B. A taxpayer receives SMS or E-mail about generation of GSTR 2B.

5) Difference between GSTR 2A and GSTR 2B

GSTR 2A is a dynamic statement whose figures keep changing based on the returns filed by suppliers. For example, a supplier includes an invoice dated 25 February 2021 in the GSTR-1 return filed for the month of September 2021, the GSTR 2A of February 2021 changes automatically. Here, you will need to check whether you claimed credit in your February 2021 return. If not, then you can claim the credit in September 2021.

Also, from the above example, the invoice will reflect in GSTR 2B of September 2021. GSTR 2B is a static statement whose figures do not change post the return filing period. In GSTR 2B, the figures get auto-populated from 12th day of previous month up to 11th day of the current month and remain locked in.

6) Provisional ITC

Under rule 36(4) of the CGST Rules, 2017, the total ITC that you can claim in GSTR 3B is 105% of the eligible ITC appearing in the GSTR 2B of a particular period. Prior to August 2020, the same was calculated based on GSTR 2A. The restriction was earlier at 10% between 1 January 2020 and 31 December 2020. Prior to that the restriction was 20% from 9 October 2019 to 31 December 2019.

An example of calculation of provisional ITC:

| Details of Input Tax Credit | As per books | ITC eligible as per rule 36(4) |

|---|---|---|

| ITC as per purchase register | 200000 | - |

| ITC as per GSTR 2B | 160000 | 160000 |

| Provisional ITC | 50000 | 8,000 (1,60,000*5%) |

| Total ITC available for GSTR 3B | 168000 | |

| ITC not available for GSTR 3B | 32,000 (2,00,000-1,68,000) |

The balance ITC is available only after their supplier uploads the invoices and the ITC gets reflected in the GSTR 2B (of a subsequent month).

Rule 86B introduced from 1 January 2021 restricts the utilization of ITC for making GST payment. Only 99% of the input tax credit is available to pay output GST liability. This rule applies to GST registered users whose taxable supplies (excluding exempted and zero-rated supply) in a month are more than Rs 50 lakh.

Exclusions from rule 86B restriction on ITC:

-

- The persons below mentioned who paid more than Rs 1 lakh as income tax in each of the last two financial years, under the Income Tax Act, 1961:

- A registered GST user such as company, LLP, partnership firm etc; or

- The proprietor or karta or the Managing Director or any of its two partners, whole-time Directors, Members of Managing Committee of Associations or Board of Trustees

- A registered GST user had received refund of more than Rs 1 lakh in the preceding financial year on account of unutilized ITC arising in case of export under LUT or inverted tax structure.

- A registered GST user already discharged output tax liability through electronic cash ledger for an amount in excess of 1% of the total output tax, applied cumulatively, up to the said month in the current financial year; or

- A registered GST user is:

- Government Department;

- Public Sector Undertaking;

- Local Authority;

- Statutory Authority

- The persons below mentioned who paid more than Rs 1 lakh as income tax in each of the last two financial years, under the Income Tax Act, 1961:

Thus, while filing your GST return, you should calculate your ITC and perform ITC reconciliation to know your ITC claim. One should bear in mind the rules on provisional ITC and restriction on ITC utilization.